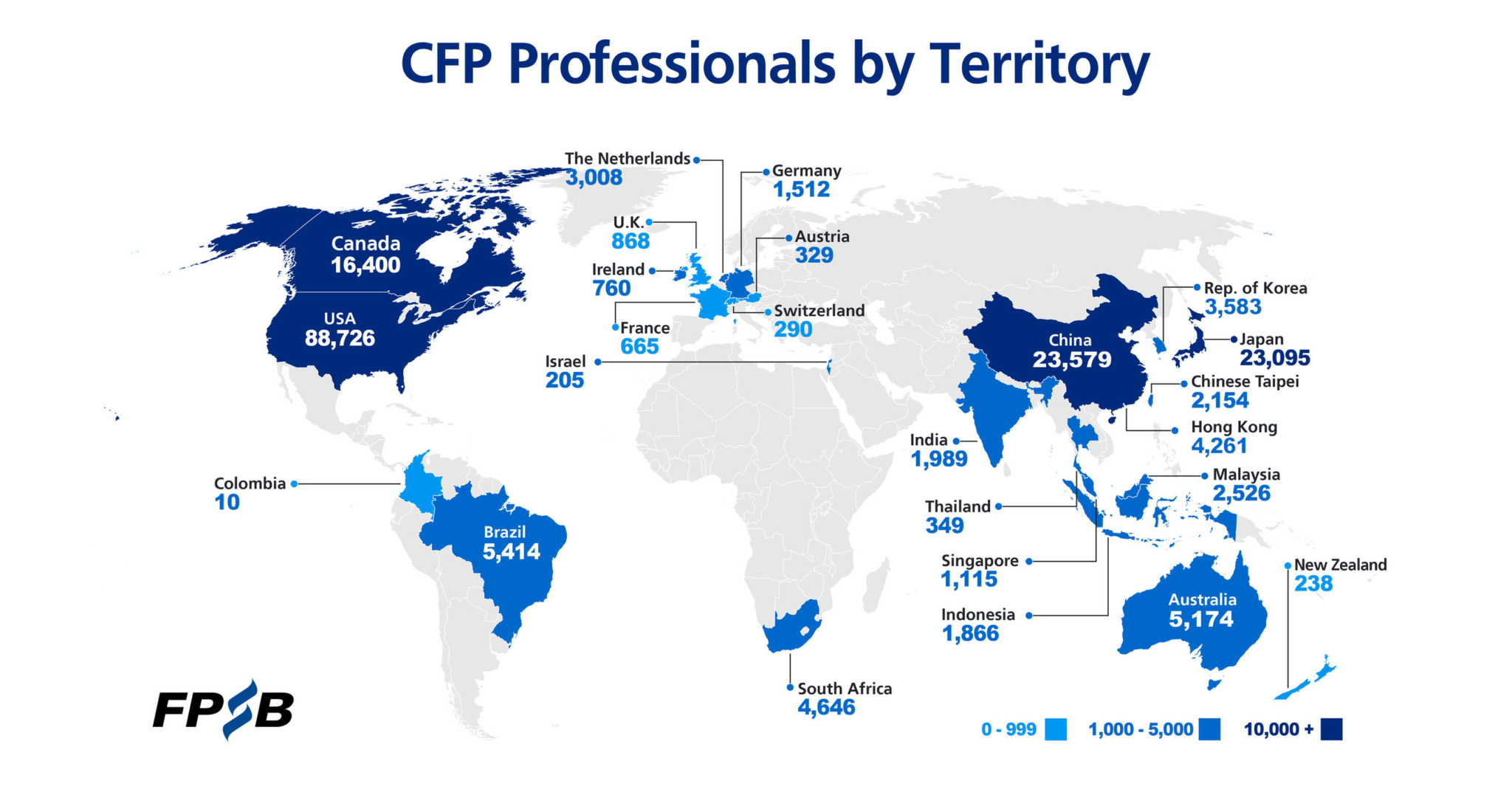

CFP Certification is a mark of excellence granted to individuals who meet the stringent standards of education, examination, experience, and ethics. It is the most prestigious and internationally accepted Financial Planning qualification with over 1,92,000 CFP Professionals in 27 territories worldwide. The CFP Certification wins’ trust and presents opportunities worldwide.

In this era of super specialization, the Professional Certification – CFP certification gears career aspirants and existing financial intermediaries for giving comprehensive financial advisory services to individuals and make a satisfying career in the financial services industry.

CFP professionals typically review relevant aspects of a client’s situation across a large range of financial planning activities, which may include Financial Management, Investment Planning, asset management, Risk management, Tax planning, Retirement planning, and Estate planning.

As of 1 April 2019, the CFP Certification program in India is now directly administered by U.S.-based Financial Planning Standards Board Ltd. (FPSB Ltd.), owner of the international CERTIFIED FINANCIAL PLANNER certification program outside the United States.

FPSB Limited, US enters into licensing and affiliation agreements with nonprofit organizations (or their equivalent) around the world that allow the organizations to establish and operate the CFP certification program in a country or region. FPSB Affiliates who meet and maintain FPSB’s affiliation criteria high standards are authorized to administer the CFP certification program on behalf of FPSB in a country or region. FPSB India is one of the Affiliate of FPSB Limited.

The CFP Curriculum is segmented into 4 levels. Upon completion of each level, FPSB awards an International Certification for that level.

CFP Level 1 – FPSB® INVESTMENT PLANNING SPECIALIST

International Certification for Investment Professionals specializing in Securities Markets & Portfolio Management

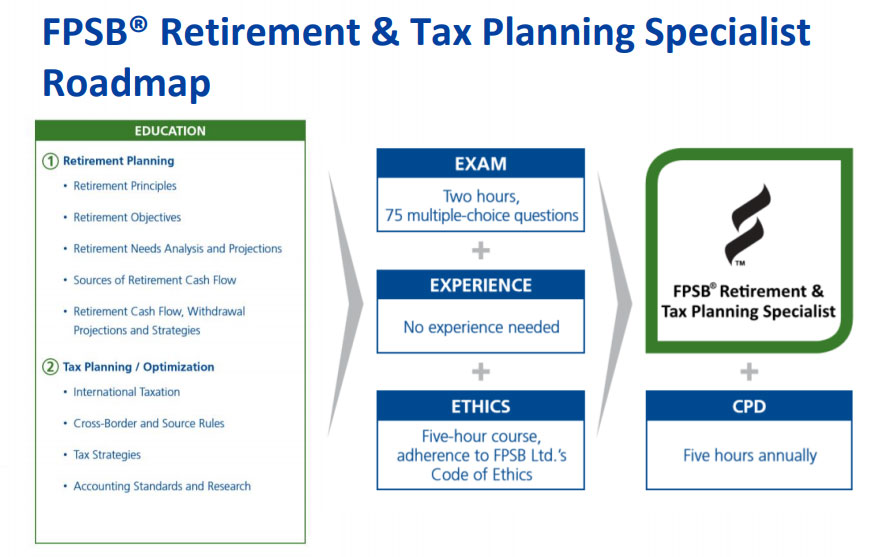

CFP Level 2 – FPSB® RETIREMENT & TAX PLANNING SPECIALIST

International Certification for Retirement Planning& Individual Tax Planning

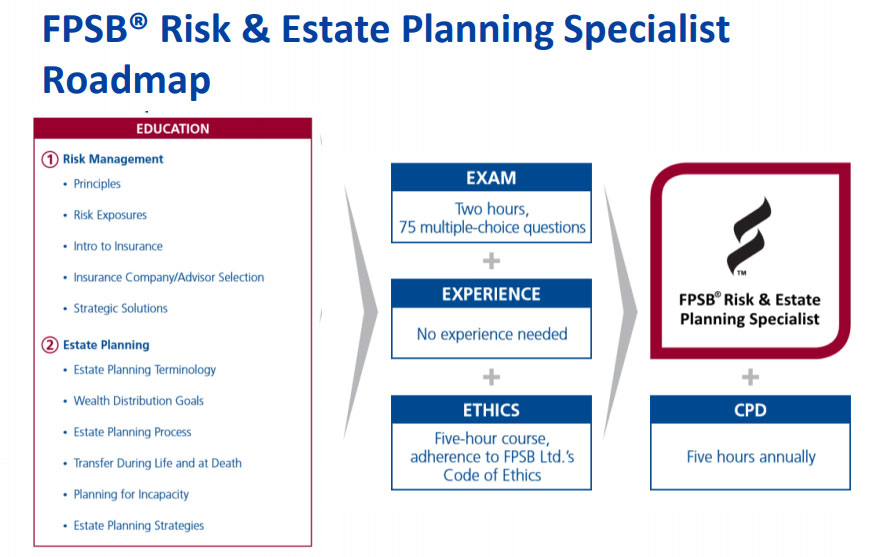

CFP Level 3 – FPSB® RISK &Estate Planning SPECIALIST

International Certification for Risk Management & Estate Planning

CFP Level 4 – CERTIFIED FINANCIAL PLANNER

Global Standard of Excellence in the field of Financial Planning & Wealth Management

Registration Fee – Rs. 18,000

FPSB Specialist Course material for first 3 Levels – Rs. 6500 each

FPSB IFP Course material Fee Rs. 13,000

FPSB Specialist Exam fee for first 3 Levels - Rs. 6750 each

FPSB Financial Plan Assessment & CFP Final Exam Fee – Rs. 23,500

FPSB Specialist Certification Fee – Rs. 8600

On registration, IIFC will give you discount coupons worth Rs. 16,250 which will be applied when candidates buy Course material.

Education: Students who are at least age 18 and have completed HSC/12th (Std XII/HSC) may register for the program. Though the CFP Certification can be provided only after you complete your graduation. Students pursuing BCOM, BBA, MBA, MBA, CA & CS can register for this Certification. This global certification with specialization in Personal Finance & wealth management give you an edge in Job placement & Fast track growth of Career.

Experience: Experience is one of the four criteria verified before a candidate is conferred CFPCM certification. The experience criterion is considered an opportunity for the candidate to apply his/her financial planning knowledge and skills in one or more of the eight competency profiles outlined under the Financial Planning Curriculum Framework.

It is preferable for a candidate to demonstrate his/her capability by way of an acquired work experience that involves the development of a financial plan in accordance with the six-step process of financial planning. However, considering the incipient nature of the financial planning industry in India, it is felt desirable to confer the certification of even those candidates who could demonstrate having put in an adequate number of years in the financial services sector and satisfying one of the competency profiles. This helps professionals from various financial services consolidate their efforts and launch full-fledged financial planning services. The experience accepted is of three years.

Currently, a candidate is required to furnish valid experience of three to five years depending on his/her work experience in financial planning or various financial services, and his/her basic qualifications. The experience is required to be completed prior to or after passing the final certification examination.

For Students, One-year Internship under Practicing CFP as a Supervisory experience also fulfil the experience criteria requirements as per FPSB guidelines.

Candidates of the new program who have passed all the three Specialist certification exams (FPSB® Investment Planning, FPSB® Risk and Estate Planning, and FPSB® Retirement and Tax Planning), and have completed the Ethics course and have also taken all the three Specialist certifications are eligible to register for the FPSB® Integrated Financial Planning course.

Active candidates of the legacy pathway who have passed all the 4 components of the legacy exam (Exam 1 to 4) are also eligible to register for the FPSB® Integrated Financial Planning course after transitioning to the new program, completing the Ethics course and taking all the three Specialist certifications. Candidate has to pay consolidated Specialist Certification fee of 100$ which is to be renewed every year.

Candidates pursuing the FPSB® Integrated Financial Planning course have the option to be guided by Mentors, who are CFP CM professionals approved under the FPSB Mentorship Program. It is an informal structure with no obligation to either party. Candidates can take advantage of the mentor’s experience, knowledge and practice skills to develop their learning on financial plan construction. The Mentor shall work with the candidate in a defined number of interactions wherein the candidate will be provided practical insights on his/her approach to the preparation of a financial plan.

A candidate in the New Program is given up to a maximum of 3 years from the date of registration to complete all the Specialist exams or start all over again on the way to CFP certification. It is assumed that 12-15 months is a good enough duration to complete the entire exam criteria.

There are no pre-approved cut score or pass marks percentage in New Program exams. The exams are assessed for uniform difficulty on month to month and are initially fixed and subsequently equated every month based on a metric that underlines capability of passed candidates to practice on the market place the skills that they acquire.

Yes. When a CFP professional wants to practice financial planning using the CFP marks in more than one territory, the CFP professional must become certified to use the CFP marks in each territory where the CFP professional intends to practice. If a practitioner becomes certified in more than one territory, he or she must abide by the certification renewal requirements of the FPSB affiliate organization in each territory, and will also be subject to oversight by the FPSB affiliate organization in each territory.

For more information on requirements in a specific territory, please refer to that territory’s specific website. For a list of FPSB affiliate organizations, please see https://www.fpsb.org/about/member-organizations/.

In 2019, FPSB Ltd. began issuing new digital credentials to all current CFPCM professionals in India. Consisting of a digital certificate and a digital badge, FSPB Ltd.’s online credentialing system will replace the paper certificates issued to you in the past. However, should you wish to print and frame your certificate from FSPB Ltd., you will have an option to do so.

Your digital credential for CFP certification, which is block chain-verified to help prevent fraud, will allow people to securely and easily verify your CFP certification status across all types of online platforms, including your email signature, website, blog, LinkedIn profile and other social media accounts. FPSB Ltd. is pleased to offer this technology to CFP professionals in India, and will provide additional information on how to leverage these digital credentials to highlight your achievements as a CFP professional at the time of delivery.

Always Accessible – Never worry about losing your certificate; your credential will always be present at its web address.

Easily Shareable – You want to share your achievement. Digital credentials let you showcase your achievement on Facebook, Twitter and LinkedIn.

Control Your Privacy – Take advantage of search ability and have your achievement be discoverable on search engines, or set it to private and share with only selected people. How and when you share your credential is up to you.

Print at Any Time – Easily print a high-quality PDF of your certificate, whenever you’d like.

Learning, Verified. – Your achievement can be verified at any time. Your certification(s) on LinkedIn can be linked to your live credential so anyone, anywhere can see what you have achieved.

Candidates pursuing the FPSB® Integrated Financial Planning course have the option to be guided by Mentors, who are CFP CM professionals approved under the FPSB Mentorship Program. It is an informal structure with no obligation to either party. Candidates can take advantage of the mentor’s experience, knowledge and practice skills to develop their learning on financial plan construction. The Mentor shall work with the candidate in a defined number of interactions wherein the candidate will be provided practical insights on his/her approach to the preparation of a financial plan.

Candidates pursuing the FPSB® Integrated Financial Planning course have the option to be guided by Mentors, who are CFP CM professionals approved under the FPSB Mentorship Program. It is an informal structure with no obligation to either party. Candidates can take advantage of the mentor’s experience, knowledge and practice skills to develop their learning on financial plan construction. The Mentor shall work with the candidate in a defined number of interactions wherein the candidate will be provided practical insights on his/her approach to the preparation of a financial plan.

| Features | CFP Regular Pathway |

| Classroom Lectures | |

| Recorded Video lectures | |

| Instructor 1 on 1 support to resolve doubts | |

| Mock Exams | |

| Physical Study material |